Indiscriminate forgiveness in tax collection and culture, in the Municipality of Barranca period 2018-2019

DOI:

https://doi.org/10.51252/rcri.v5i1.890Keywords:

tax forgiveness, tax compliance, tax administration, local governmentsAbstract

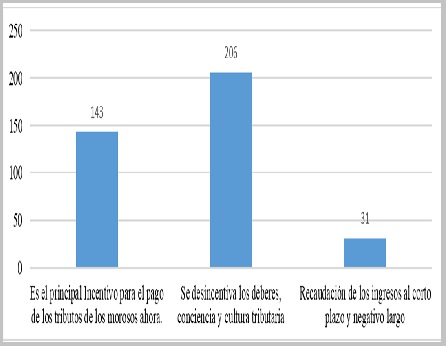

The research analyzed the impact of tax forgiveness policies on the compliance culture of taxpayers in the Provincial Municipality of Barranca, Peru. Faced with increasing delinquency and poor implementation of these measures by the municipal government, the existence of a significant relationship between indiscriminate forgiveness and tax awareness was sought. Likewise, it examined how the perception of municipal services and collection influence tax compliance. With a quantitative approach and correlational design, the study worked with taxpayers who benefited from the forgiveness of interest and fines between the periods 2018 and 2019. The sample of 380 taxpayers was randomly selected under stratified criteria. The results showed an increase in the perception of fairness of the forgiveness, in the registration of taxpayers and in the collection of coercive collections and tax amnesties. Likewise, there were improvements in tax education, knowledge of tax obligations and timely compliance, as a result of awareness strategies implemented during the period. The study concluded that comparative research is needed in other municipalities to improve collection practices and promote greater tax awareness in the country.

Downloads

References

Alcívar Toala, K. J., Carbo González, M. F., & Paredes Floril, P. (2024). La Evasión Fiscal como Efecto a la Carencia de Cultura Tributaria en los Contribuyentes del Guayaquil. Revista Multidicplinaria Voces de América y el Caribe, 1(2). https://remuvac.com/index.php/home/article/view/81

Córdova Baldeón, I. (2020). Instrumentos de investigación (2.a ed.). EDITORIAL SAN MARCOS E I R LTDA.

Graneros Pareja, S. E., & Jimenez Loayza, A. C. (2023). Evasión y elusión tributaria de rentas de cuarta categoría en la recaudación tributaria generadas por profesionales independientes de la ciudad del Cusco, periodo 2019-2020 [Universidad Nacional de San Antonio de Abad del Cusco]. http://hdl.handle.net/20.500.12918/7678

Hernández Sampieri, R., Fernández Collado, C., & Baptista Lucio, P. (2014). Metodología de la investigación (6ta ed.). McGraw-Hill Education.

Lira-Camargo, Z. R., Nieves-Chen, J. H., & Lira-Camargo, J. (2024). Elusión tributaria y la recaudación del impuesto a la renta en el Perú. Revista de Ciencias Sociales, 30(9), 437-446. https://doi.org/10.31876/rcs.v30i.42323

Macías Loor, F. I., & Parrales Pincay, M. E. (2023). La cultura tributaria como mecanismo clave en el cumplimiento de las obligaciones fiscales. Polo del Conocimiento, 8(2), 878-894. https://polodelconocimiento.com/ojs/index.php/es/article/view/5223

Montero Granados, R. (2016). Modelos de regresión lineal múltiple [Universidad de Granada]. https://www.ugr.es/~montero/matematicas/regresion_lineal.pdf

Municipalidad Provincial de Barranca. (2019). Memoria anual de gestión 2018 (p. 151). Gobierno del Perú. https://cdn.www.gob.pe/uploads/document/file/1751430/Memoria 2018.pdf

Robles Moreno, C. del P. (2010). La Condonación en materia Tributaria: Aspectos Críticos. Foro Jurídico, 226-233. https://bit.ly/3j9ZzC4

Suarez Rios, H. M., Palomino Alvarado, G. del P., & Aguilar Saldaña, C. M. (2020). Gestión de recaudación tributaria municipal: Una visión cultural. Ciencia Latina Revista Científica Multidisciplinar, 4(2), 635-654. https://doi.org/10.37811/cl_rcm.v4i2.105

Tuero Fernández, A. (2024). Gestión Fiscal (1.a ed.). Ediciones Paraninfo, S.A.

Urquizo Armas, J. V., Ivonne Narváez, Zurita, C., & Jaramillo Calle, C. Y. (2024). Cultivando conciencia tributaria: estrategias educativas y colaborativas en América Latina. Revista Universidad y Sociedad, 16(2). http://scielo.sld.cu/scielo.php?pid=S2218-36202024000200282&script=sci_arttext

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Universidad Nacional Federico Villareal

This work is licensed under a Creative Commons Attribution 4.0 International License.

The authors retain their rights:

a. The authors retain their trademark and patent rights, as well as any process or procedure described in the article.

b. The authors retain the right to share, copy, distribute, execute and publicly communicate the article published in the Ratio Iure Scientific Journal (RCRI) (for example, place it in an institutional repository or publish it in a book), with an acknowledgment of its initial publication in the RCRI.

c. Authors retain the right to make a subsequent publication of their work, to use the article or any part of it (for example: a compilation of their works, notes for conferences, thesis, or for a book), provided that they indicate the source of publication (authors of the work, journal, volume, number and date).